What Drove the Invention of the Cash Register?

Discover the Origins of the Cash Register: The Revolutionary Tool that Changed the Way We Shop Forever

Source medium.com

Why Was the Cash Register Invented?

The Need for Improved Sales Management

In the 19th century, businesses were growing at a rapid pace, and the increase in transactions necessitated a need for a more efficient way of managing sales. Before the invention of the cash register, sales were recorded manually, making it a time-consuming and error-prone process.

As businesses grew, the management of cash became increasingly important, and there were demands for a more efficient system. It was imperative to have a system that not only tracked transactions but also ensured accuracy in cash management.

The Problem with Manual Cash Management

Manual cash management was not only cumbersome but also prone to errors. With no proper system in place to keep track of transactions, there were high chances of employees stealing from the cash drawer. A lack of accountability led to reduced profitability for businesses, and identifying and correcting errors were extremely difficult. This made cash management a significant challenge.

Businesses were losing considerable revenue due to the inefficiencies in the manual cash management system. There was a need for a solution that could guarantee the security of cash and provide a reliable way to track, record, and manage transactions.

The Invention of the First Cash Register

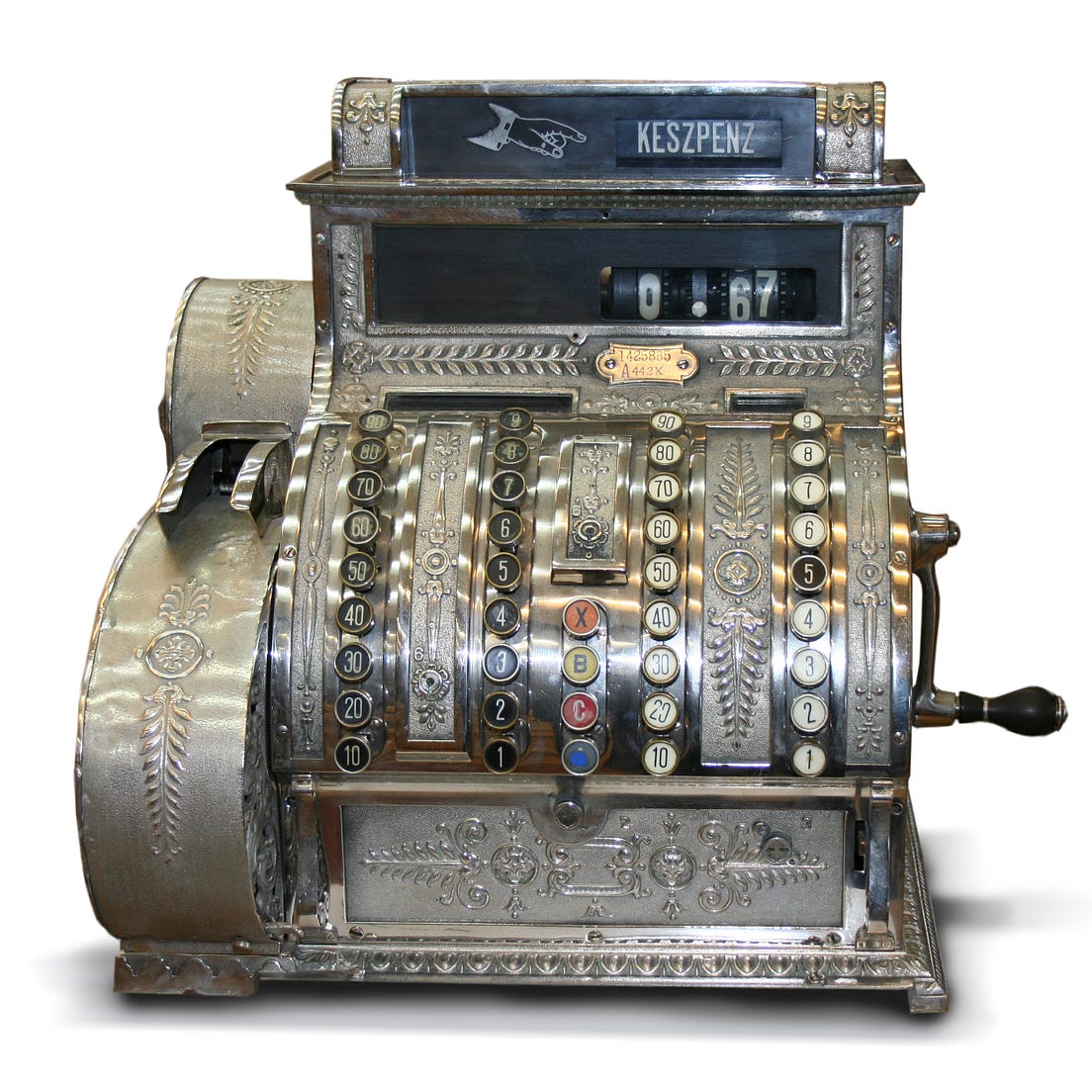

James Ritty, a saloon owner, invented the first cash register in 1879. This invention revolutionized cash management for businesses. He named it "The Incorruptible Cashier" and designed it to prevent theft and errors in cash management.

The cash register was designed with a system of levers and counters that recorded transactions and displayed the amount of cash to be returned to the customer. With the cash register, each transaction was recorded systematically, leading to increased efficiency in sales management.

The invention of the cash register provided businesses with a perfect solution to the problem of manual cash management. The cash register was a reliable way of tracking sales, inventory, and managing cash flow. The security provided by a cash register brought a significant improvement in the overall profitability of businesses.

The cash register continues to be a vital tool in modern cash management systems. With the introduction of electronic cash registers, businesses can now manage multiple transactions efficiently. The electronic cash registers are designed to maintain records, keep inventory, and generate sales reports, making it easy to track the performance of businesses with real-time statistics.

Conclusion

The invention of the cash register was a turning point in the history of sales management. James Ritty's invention transformed the way businesses managed cash, making it more efficient, reliable, and secure. It is a testament to the fact that innovations in technology can make significant contributions to the growth and success of businesses.

Today, cash registers are an integral part of business operations, and businesses can choose from a wide variety of cash registers that offer features customized to their needs. The evolution of cash registers continues with the development of more advanced electronic cash registers and point-of-sale (POS) systems that help businesses stay competitive in today's fast-paced market.

Evolution of the Cash Register

The cash register serves as one of the most essential business tools that enable the operator to record transactions and store cash securely. However, it has come a long way from its humble beginnings as simply a cash-tracking device. This section will detail the progression of the cash register development, which proves that it has long been an integral part of commerce.

Introduction of Cash Register Manufacturers

After James Ritty invented the first cash register, other manufacturers took note of its advantages and started creating their own versions. This is not surprising because once a new technology becomes widely popular and essential, other inventors and manufacturers usually try to improve on it to make it better and more efficient in its performance. Thus, the demand for other cash register brands emerged, and several companies began producing their own models with exclusive features and designs to make them stand out from the competition. Ultimately, the widespread availability served as a testament to the vital role the cash register had played in society and commerce.

Addition of Features

The modern cash register has undergone a gradual transformation over the decades. Cash registers have become more advanced, with the incorporation of features that allow for easy and efficient management of sales operations. Features like weight measurement, barcode scanning mechanisms, tax calculators, and an array of payment options have increased productivity and helped cashiers manage various transactions with minimal effort. The introduction of receipts has made it possible for customers to keep a record of their purchases, and it has also made it easier for businesses to keep track of transactions and provide accurate records for bookkeeping and auditing purposes. Cash drawers that open automatically when a cashier enters the amount of change due, have also become popular, providing safety and security for the cash collected.

Integration of Technology

In recent years, the cash register’s progress has advanced further with the integration of technology. Today's cash registers are incredibly sophisticated, as items are scanned using advanced barcode readers, the amounts are calculated automatically, and the transactions are processed using electronic payment systems. These modernized cash registers go beyond mere transaction processing as they also incorporate business management tools like inventory integration, accounting software, and CRM functionality. This technology integration has made it possible for businesses to obtain real-time information across all business functions from a central database, enabling them to make informed decisions based on accurate data while reducing errors and increasing efficiency.

Well designed Cash registers streamline the tracking of transactions, which eliminates the risks of fraud and human error in transaction processing and helps businesses maintain accurate records. Even though electronic payments have become more popular in recent years, cash transactions continue to be predominant in several parts of the world. Cash registers will be the primary tool in these places for quite some time with more advanced features expected to be incorporated as the technology progresses.

The Impact of the Cash Register on Businesses

The invention of the cash register in the late 19th century revolutionized the way businesses managed their sales and inventory. Its widespread adoption helped to standardize sales management and increase customer trust. In this article, we will discuss the reasons behind the development of the cash register, as well as its impact on businesses.

Improved Sales Management

The cash register allowed businesses to manage their sales and inventory more efficiently. Before its invention, businesses relied on manual record-keeping, which was prone to errors and inaccuracies. The cash register, on the other hand, provided an automated and accurate record of each sale, reducing the risk of mistakes. The machine's drawer also acted as a secure place to store cash and receipts, making it easier for managers to reconcile their accounts.

The cash register's introduction also made it easier for managers to keep track of their inventory. By recording every sale, businesses could quickly identify their most popular products and reorder stocks when necessary. This, in turn, helped to reduce waste and ensure that businesses were always well-stocked with in-demand items.

The improved sales management that the cash register provided was especially beneficial for larger businesses with multiple locations. By standardizing sales tracking across all of their outlets, franchisors could evaluate their performance more accurately and make adjustments as needed. This increased efficiency and accuracy allowed businesses to maximize their profits and minimize their overheads.

Increased Customer Trust

One of the main benefits of the cash register was its ability to increase customer trust. Before its invention, it was not uncommon for businesses to manipulate their accounts or steal money from the customer's payment. Without a clear and accurate record of each transaction, customers were often left with no recourse if they suspected foul play.

The cash register provided a solution to this problem by providing an accurate record of each transaction. The customer could visibly see the amount they owed and could observe that the transaction was properly recorded. If any discrepancies arise concerning the transaction, the cash register's receipts will serve as concrete evidence of the sale.

Customers, satisfied that their transactions were correctly recorded, felt safer shopping in stores that use cash registers. With increased customer trust and confidence, businesses could build a loyal customer base that would lead to increased sales and repeat purchases.

Standardized Sales Management

The use of cash registers standardized sales management, allowing for better comparison of sales data and easier analysis of business performance. This standardization allowed businesses to compare sales volumes across different stores and locations, making it easier to identify which sites were generating the most revenue.

Because the cash register provided a standardized accounting method, businesses could evaluate their sales figures with a higher degree of accuracy. This made it easier to identify inefficiencies in the business model and correct them promptly.

Standardized sales management also made it easier for businesses to adapt to changing market conditions. By identifying the best-performing products and promoting them across all stores, businesses could quickly adapt to new customer requirements and capitalize on their success.

Conclusion

The cash register revolutionized sales management, increasing efficiency, accuracy, and customer trust. Its widespread adoption marked the beginning of modern retail business practices, and its impact can still be seen today. By providing a standardized sales management method, cash registers allowed businesses to grow, compete, and succeed in an increasingly complex and competitive marketplace.

The Role of the Cash Register Today

Continued Use in Traditional Retail

Cash registers have been a staple in traditional retail settings for well over a century. Despite advancements in technology and the rise of digital transactions, many businesses still rely on cash registers to process sales transactions.

One reason for this continued use is the simplicity and reliability of cash registers. Unlike complex computer systems, cash registers are easy to use and have fewer technical issues. This makes them a dependable option for small businesses that may not have the resources to invest in more advanced technology.

In addition, cash registers provide a physical record of transactions. This makes it easier for business owners to track sales, monitor inventory levels, and balance the books at the end of the day.

Integration with Digital Transactions

In recent years, cash registers have undergone a significant transformation. Today's cash registers are not only used for cash transactions, but they have also been integrated with digital payment systems.

Many businesses now accept a variety of payment methods, including debit and credit cards, mobile payments, and e-wallets. Cash registers have evolved to accommodate these payment methods, making it easier for businesses to offer flexibility and convenience to their customers.

This integration has also helped to reduce the risk of errors and theft. Digital transactions are recorded automatically, eliminating the need for manual entry and reducing the risk of human error. Additionally, cash registers can be programmed to detect fraudulent transactions and prevent unauthorized access.

Future of Cash Registers

As technology continues to evolve, cash registers are poised to become even more sophisticated. In the future, we can expect cash registers to incorporate even more advanced features, such as facial recognition technology and artificial intelligence.

These advancements will allow for greater connectivity between different business systems. For example, a cash register could be linked to an inventory management system, automatically updating inventory levels in real-time as sales are made.

Additionally, cash registers may become more customizable, allowing businesses to tailor the user interface to their specific needs. This could include features such as multilingual support or integration with loyalty programs.

In conclusion, the cash register has come a long way since its invention in 1879. Today, it remains an essential tool for businesses of all sizes and has continued to adapt and evolve with the changing needs of consumers and advances in technology.